- John Watson

- Sep 13, 2018

- 6 min read

Updated: Dec 9, 2018

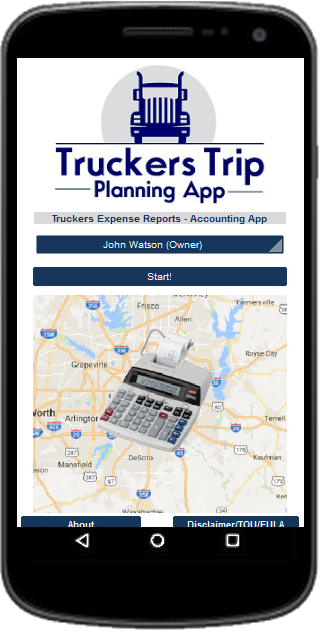

With the Truckers Expense Reports and Accounting for Truckers App, lease operators and owner operators can maintain their income statement, build their business balance sheet by recording their trucking expenses, Company Truck Drivers can record their personal expenses while maintaining their own accounting system.

To use the Truckers Expense Reports and Accounting for Truckers App, follow these step-by-step instructions:

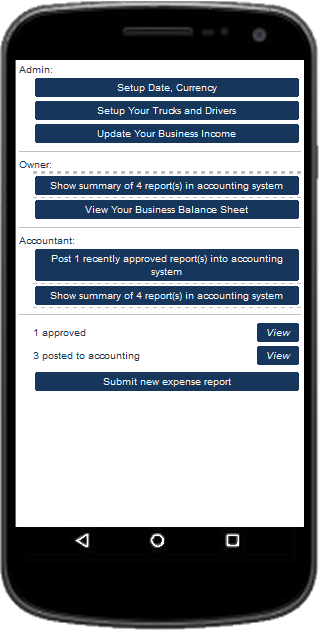

When the app opens it opens to the Home page. From there select "Owners Name" and click on "Start". This will take you to the "Task Selection" page of the App where you will see three roles; "Admin", "Owner", and "Accountant".

Set up your Date and Currency Preferences

Start by clicking on the button to Set up your Date and Currency Preferences under "Admin".

Use the "Date Selection" drop down box to choose the format you want to use.

Next use the "Currency Code" drop down box to choose your currency.

Now Check your "Prefix" or "Postfix" symbol.

Finally, change the "Currency Exchange Rate" direction that you want to use for your truckers accounting system.

"Save and Close" the page and it will return you to the "Task Selection" page.

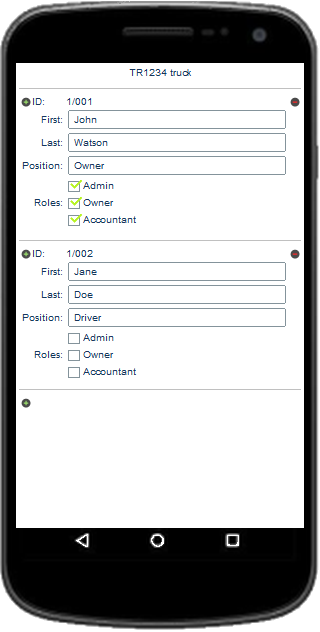

Setup Your Trucks and Drivers

Click on the button to "Setup Your Trucks and Drivers" and choose "Edit".

Edit the Truck Number to your Truck Number.

Now Click on the button to "Edit your Truck's Drivers".

Change "Owners" to your First Name.

Change "Name" to your Last name. NOTE: Leave your "Position" as "Owner" and Leave "Admin", "Owner", and "Accountant" checked. This allows you to be able to perform all of the Task necessary to use the full functionality of the App. NOTE: If there is another Team Driver or Student in your Truck, Click on the + sign to add another driver.

Enter the Drivers First Name, Last Name, and enter his position as "Driver". DO NOT ADD ANY ROLES TO This Driver.

Click on your Devices "Back Button". NOTE: If you have more Trucks then you will need to set them up now. IF NOT Click on the SAVE AND CLOSE button to return to the Task Selection Page. IF You Do:

Click on the + sign to add your next Truck.

Enter The "Truck Number".

Now Click on the button to "Edit your Truck's Drivers".

SCROLL DOWN and Click on the + sign. You will see that the Truck ID is now your second truck.

Do this for each Driver in the Truck: Enter the Drivers First Name, Last Name, and enter his position as "Driver". DO NOT ADD ANY ROLES TO The Driver.

Click on your Devices "Back Button".

Click on "Save and Close" to return to the "Task Selection" Page.

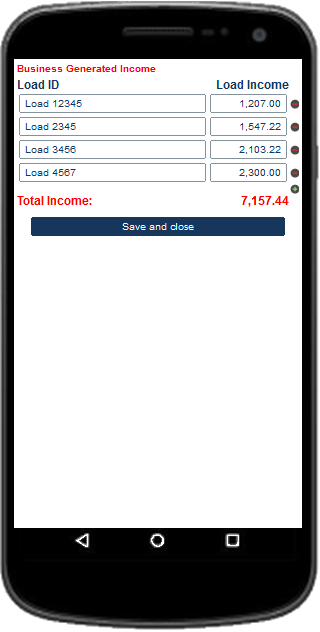

Update Your Business Income

Click on the Button to "Update Your Business Income".

Update the Load ID's and Load Income for each of your Year To Date Loads.

Then Click on "Save and Close" and return to the "Task Selection" Page.

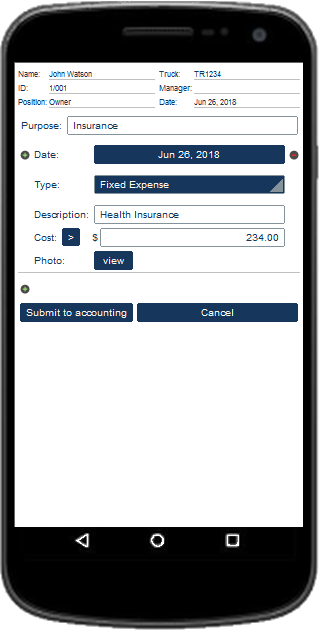

Submit New Expense Reports

Now Click on the "Submit New Expense Report" button. NOTE: You will do the the next set of instructions to update each of your year to date expenses to get the app up to date.

Click into the "Purpose Field" and type a purpose that will help you to remember why the expense occurred. If at all possible For Fixed Expenses ( type Weekly or Monthly Payment or Insurance and such) and for Variable Expenses (type the Load ID and info such as fuel 100 gallons or such) or for Personal Cost (Meals and such).

Change the "Date" to the Date when the expense occurred.

Use the "Type" Drop Down Box to select the type of expense. Match this expense to the same type as that which is used on your Owner Operator #CostPerMileWorksheet unless it is a "Personal Expense".

In the "Description Box", type the purpose of the expense. Use Phrases such as those listed on your #OwnerOperatorCostPerMilespreadsheet. For example ( Tractor Fuel, Truck Cost, Refer Fuel, Lumper, Health Insurance, Tolls, Meals, Hotel, etc.).

In the "Cost Box" type the amount found on the receipt.

Click on the "ADD" Button to add a photo of the receipt. NOTE: You can choose to get the photo from your Camera or your Photo Gallery.

Select "Camera" to take a Photo of the receipt and take the photo.

Click on the "Check Mark" to accept the image or the "Delete" button to take it again.

Click on "OK". NOTE: Select "Gallery" to get the photo from your devices photo gallery.

Click on the "Submit to Accounting" Button.

Post The Expense Report Into The App's Accounting System.

Under "Accountant" Click on the button to post the expense report into the app's #accountingsystem.

Click on the "Mark As Posted To Accounting" Button.

NOTE: As the Owner and Accounting you can look at a summary of the expense reports in the accounting system or you can use the "View" button to look at the expense reports submitted by you. (See Below)

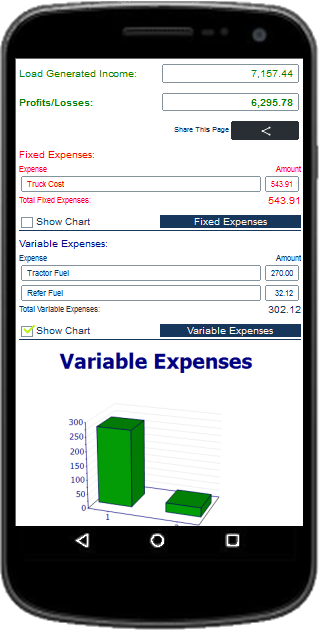

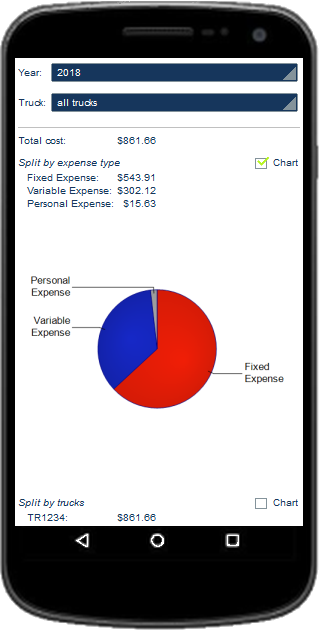

NOTE: As the Owner You can use the "View Your Business Balance Sheet" to see your "Business Balance Sheet" and your "Owner Operator #ProfitandLoss Statement". You will also be able to review a Bar Chart of the #truckingexpenses spreadsheet. (See Below)

Update The Expense Reports For Your Additional Trucks and Drivers

From the "Task Selection Page", Click on your "Devices Back Button".

Click on the "Driver Selection" Button if you have other Drivers and other Trucks.

You should now see all of your Truck drivers in the Drop Down Box. NOTE: THIS APP ASSUMES THAT YOU HAVE YOUR DRIVERS SEND RECEIPTS AND EXPLANATIONS OF THEIR TRUCKING EXPENSES. YOU WILL NEED THIS TO NOW ENTER ACCOUNTING FOR TRUCK DRIVERS IN YOUR TRUCKS. NOTE: You will need to follow these procedures for each of your Truck Drivers.

Select one of the drivers from the list so that you can enter the truck drivers expense reports into your accounting system.

Click on the "Start" Button.

Now Click on the "Submit New Expense Report" Button.

Update each of your drivers year to date expenses to get the app up to date in the same manner in which you updated your own expenses. NOTE: You will be able to use the "View" Button to see each of the reports for the driver after they have been submitted for approval.

Click on your "Devices Back Button".

NOTE: After updating each of your drivers expense reports you will need to Approve them and Post them into the Apps Accounting System.

Approve Your Additional Trucks and Drivers Expense Reports and Post them into the Apps Accounting System

Click on the "Driver Selection" Drop Down Box and select your name.

Click on the "Start" Button.

Under "Owner" Click on the button to "Approve New Expense Reports Submitted By Any Driver". NOTE: You will have the option to "Approve" or "Reject" the Expense Report. If you posted the expense because you have approved it you will probably not need to use the "Reject" Button. However, if you want to keep a record of rejected expenses you can record them this way and be able to review each of the rejected expense reports when viewing the app using the Drivers Name. The expenses will not be added into the Accounting System.

Select "Approve" and return to the "Task Selection Page".

Under "Accountant" Click on the button to "Post the Approved Expense Report" into the accounting system.

Click on the Button to Mark the expense report as "Posted to Accounting" and return to the "Task Selection Page".

After you have approved and posted each drivers year to date expense reports and your Truckers Expense Reports App is updated;

From the "Task Selection" page:

View submitted and approved expense reports, Review a summary and charts for all of the expense reports in the accounting system By Year, By Truck, By Expense, and By Drivers. You can Add New Trucks and Drivers, Update Your Business Income, Submit New Expense Reports, Email and Download The Business Balance Sheet for Loading To Excel Using The Share Button.

Use your "Devices Back Button" to exit the App. Your Work will be Saved and available when you need to update or review.

The Truckers Expense Reports and Accounting for Truckers App is available in your download with a Full Access to the Truckers Trip Planning App, it is included in the Solo Lease and Owner Operator Trip Planning App, the Team Lease and Owner Operator Trip Planning App, the Solo Company Driver Trip Planning App, and the Team Company Drivers Trip Planning App. The app is also available as an individual app here: Truckers Expense Reports and Accounting for Truckers App.

.jpg)

.png)