- John Watson

- Sep 18, 2018

- 3 min read

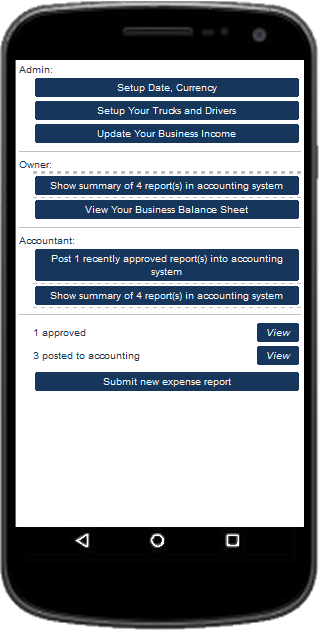

The Truckers Trip Planning App allows truck drivers to see within minutes whether they have the required hours of service to safely and legally run a load while at the same time it allows Owner Operators the opportunity to see immediately whether the load is profitable enough to sustain a successful business.

Young and Healthy Marketing LLC, a software development company in Virginia, first introduced the "Truckers Trip Planning App" to the trucking Industry in March of 2016 as a tool to help professional drivers analyze loads based on hours of service prior to accepting loads that they had no way of delivering on time or loads that were not at all profitable. The original "Truckers Trip Planning App" was the first app on the market to incorporate hours of service trip planning tools and load profitability tools to help truck drivers see if they have the required hours of service to run the load, if they can deliver the load on time, and determine whether that load is profitable in less than 5 minutes and thus coined the workflow as "Putting The Horse Before The Cart In Trucking!" The overall purpose of the Truckers Trip Planning App is to eliminate the stress and frustrations that truck drivers face on a daily basis in making load decisions and to create a cohesive and win, win relationship between Professional Drivers and Dispatchers.

The Truckers Trip Planning App takes into consideration that when the Dispatcher assigns a load, they need truck drivers to respond quickly as to whether they will accept the load so that they can begin planning their next load and likewise, Lease Operators and Owner Operators that get their loads from load boards need to decide quickly as to whether they will run a load before someone else grabs it.

The Truckers Trip Planning App is simple to use. Yet, it delivers powerful results that help Professional Drivers make informed and accurate load decisions:

In the Truckers Trip Planning App initial setup:

Company Drivers, Lease Operators, and Owner Operators can setup their Hours of Service Recap Calculator so that it is up to date and only need to add their hours for the current day when calculating their hours of service recap to determine the hours they have available for the load.

Lease Operators, and Owner Operators can setup their Operating Cost Per Mile Calculator and determine their operating cost per mile so that the tool is up to date each time they need to analyze a load.

When using the Truckers Trip Planning App to analyze hours of service,

Company Drivers, Lease Operators, and Owner Operators can simply check and make changes to their hours of service recap, and make changes to their operating cost per mile worksheet when needed.

Company Drivers, Lease Operators, and Owner Operators can simply type the load's requirements into the Trucker Trip Planning Worksheet and review the Hours of Service and ETA Calculator which automatically reports:

the load's drive time requirements,

the load's on-duty not driving time requirements,

the load's rest breaks requirements,

the load's Estimated Time of Arrivals (ETA),

the Next Available Time (NAT) after delivery,

and the remaining hours of service for their next load.

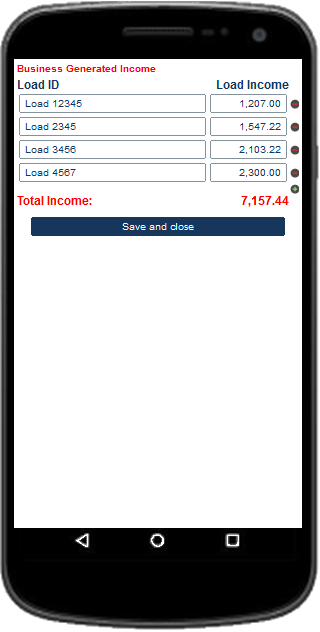

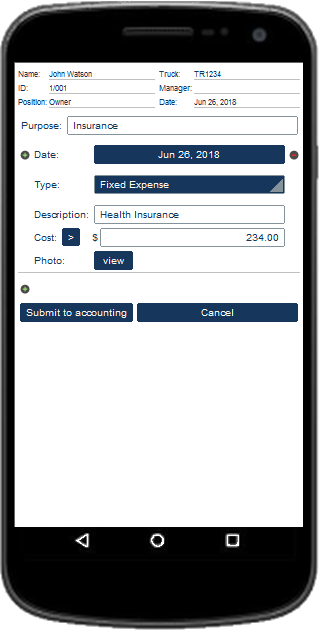

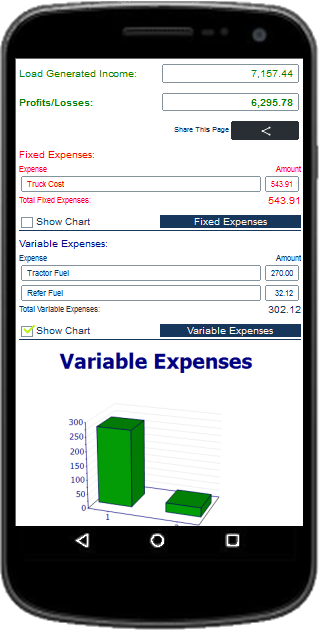

When using the Truckers Trip Planning App to analyze the load's profitability,

Lease Operators, and Owner Operators can simply input their trucks average miles per gallon, the average cost of fuel, their percentage of the load's pay, and their percentage of the load's fuel surcharge into the Trucker Trip Sheet and the Truckers Trip Planning App will calculate and render:

the load's actual load pay,

the load's actual fuel surcharge,

the load's rate per mile,

and the overall revenue that the load will generate.

To determine whether the load is profitable, Lease Operators, and Owner Operators can then go to the Profit and Loss Spreadsheet to review;

the total amount of fuel needed for the load,

the per mile cost of the needed fuel,

the total cost of the needed fuel,

the salary cost for the load,

the operating cost for the load,

and most important the profit or loss for the load.

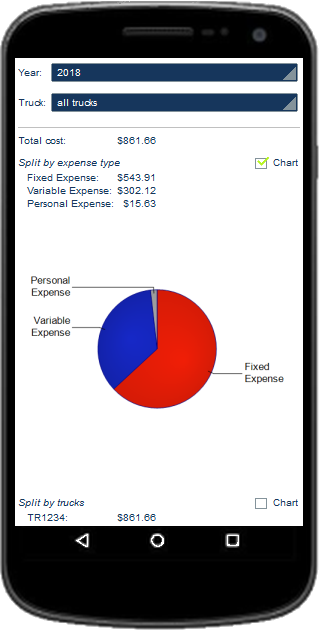

When using the Truckers Trip Planning App to measure the success of load decisions,

Lease Operators, and Owner Operators will appreciate that the Truckers Trip Planning App includes Success Metrics which records data from all of their accepted loads and provides a visual tool to help them keep their business on track towards success. Using this tool, Lease Operators, and Owner Operators can easily see where and when improvements need to be made on their load selections.

Company Drivers, Lease Operators, and Owner Operators alike will surely find that if they want to be successful, that the Truckers Trip planning App is the best and most useful app to have in their truck.

Plan To Be Successful! Get Access to the Truckers Trip Planning App and make informed and accurate load decisions.

.jpg)

.png)